34 in an aggregate expenditures diagram, a lump-sum tax (t) will

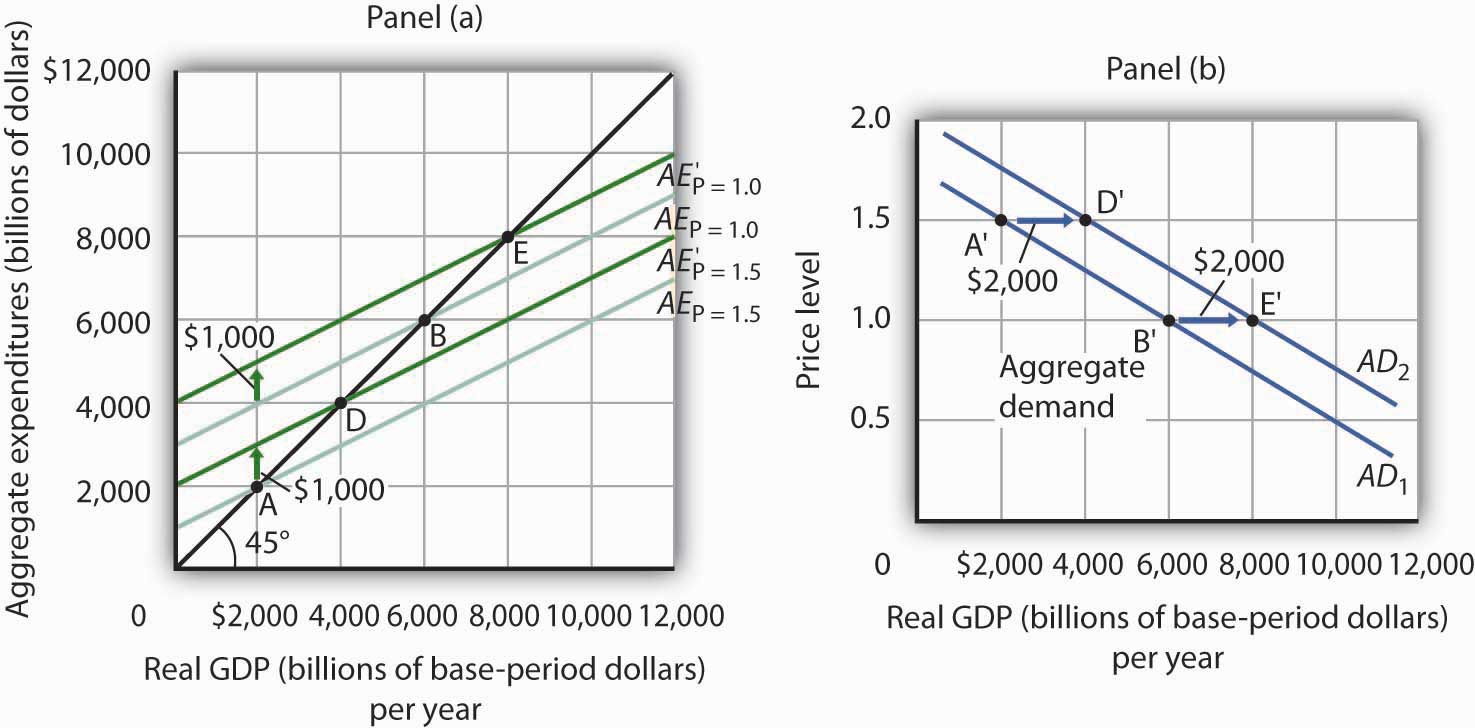

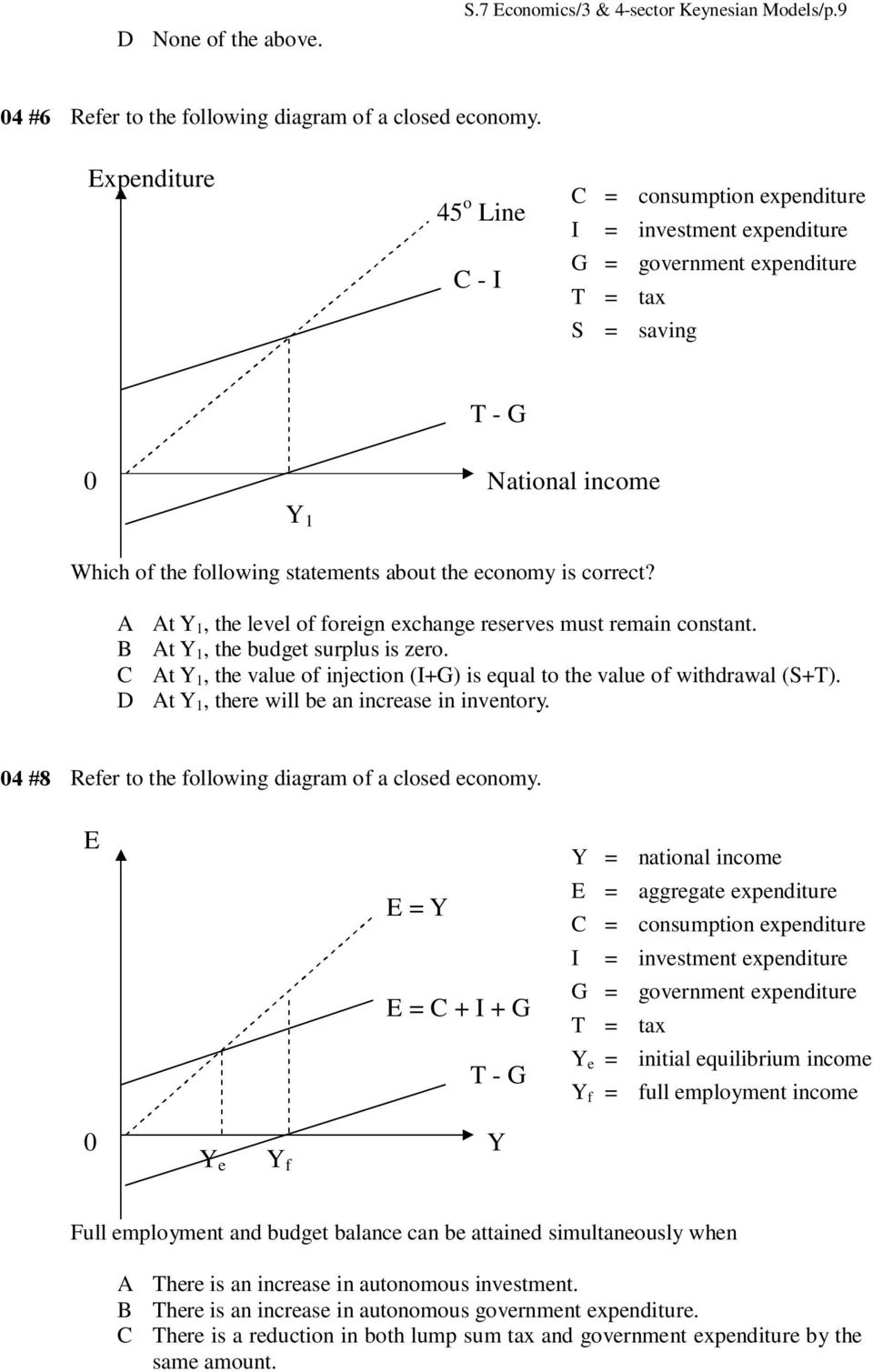

In an aggregate expenditures diagram, equal increases in government spending and in lump-sum taxes will shift the aggregate expenditures line upward. Assume that for the entire business sector of a private closed economy, there are $0 worth of investment projects that will yield an expected rate of return of 25 percent or more.

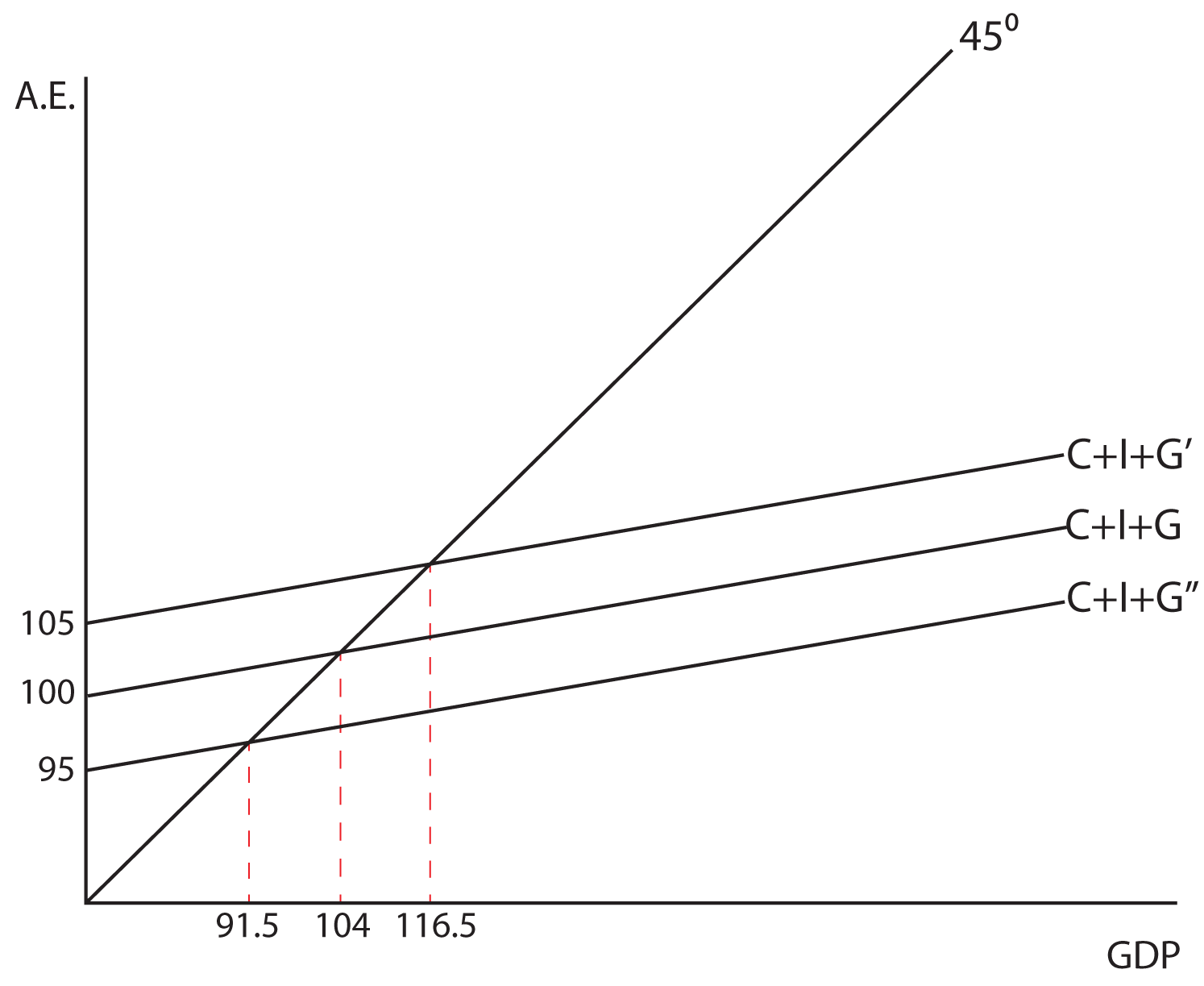

14. In an aggregate expenditures diagram, a lump-sum tax (T) will: A. not affect the C + I g + X n line. B. shift the C + I g + X n line upward by an amount equal to T. C. shift the C + I g + X n line downward by an amount equal to T. D. shift the C + I g + X n line downward by an amount equal ...

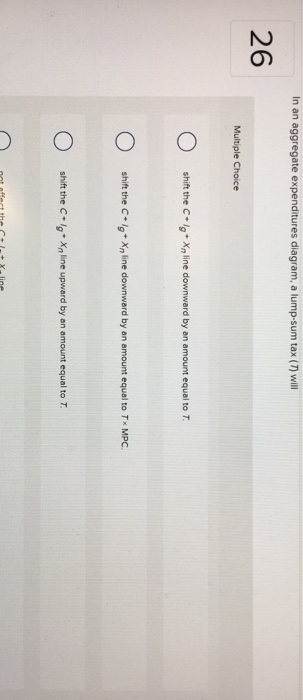

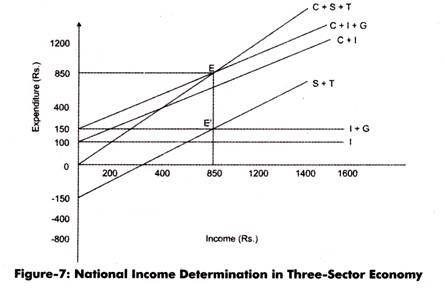

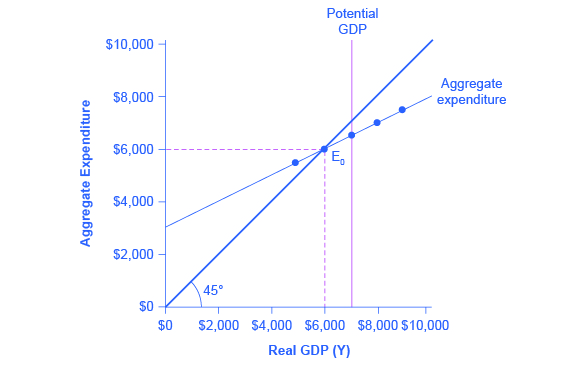

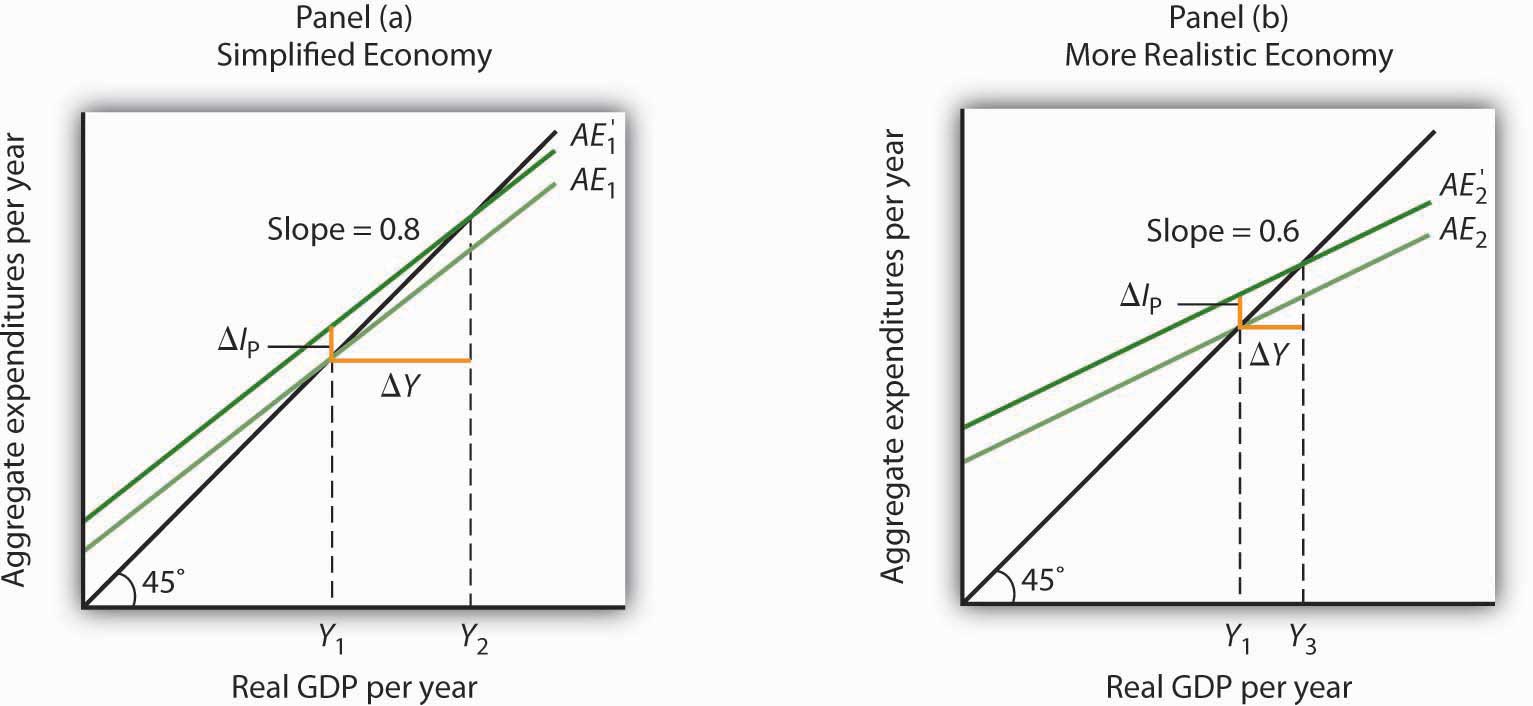

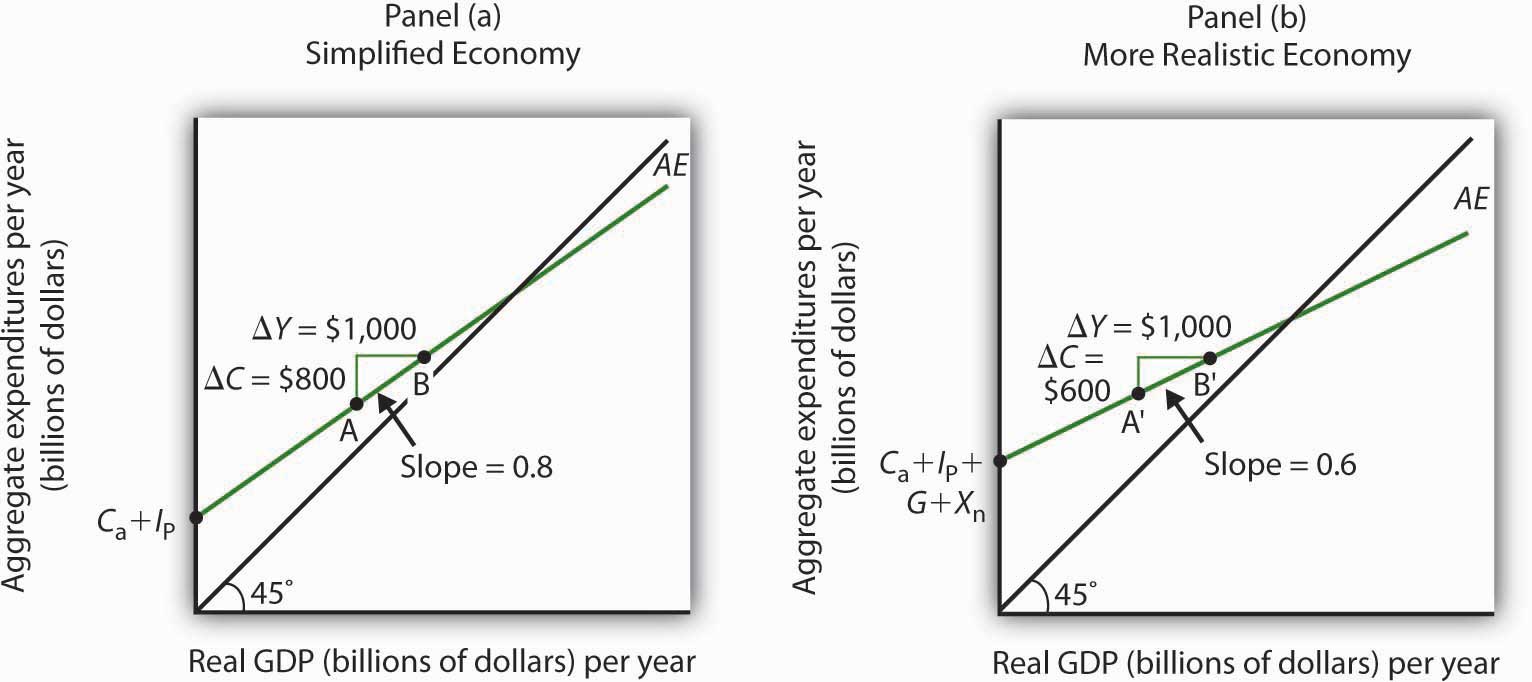

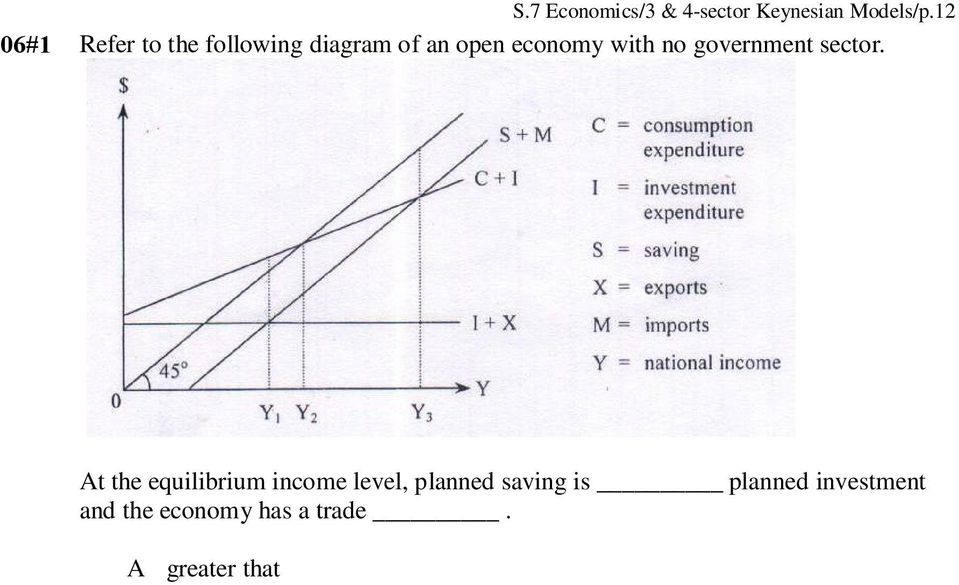

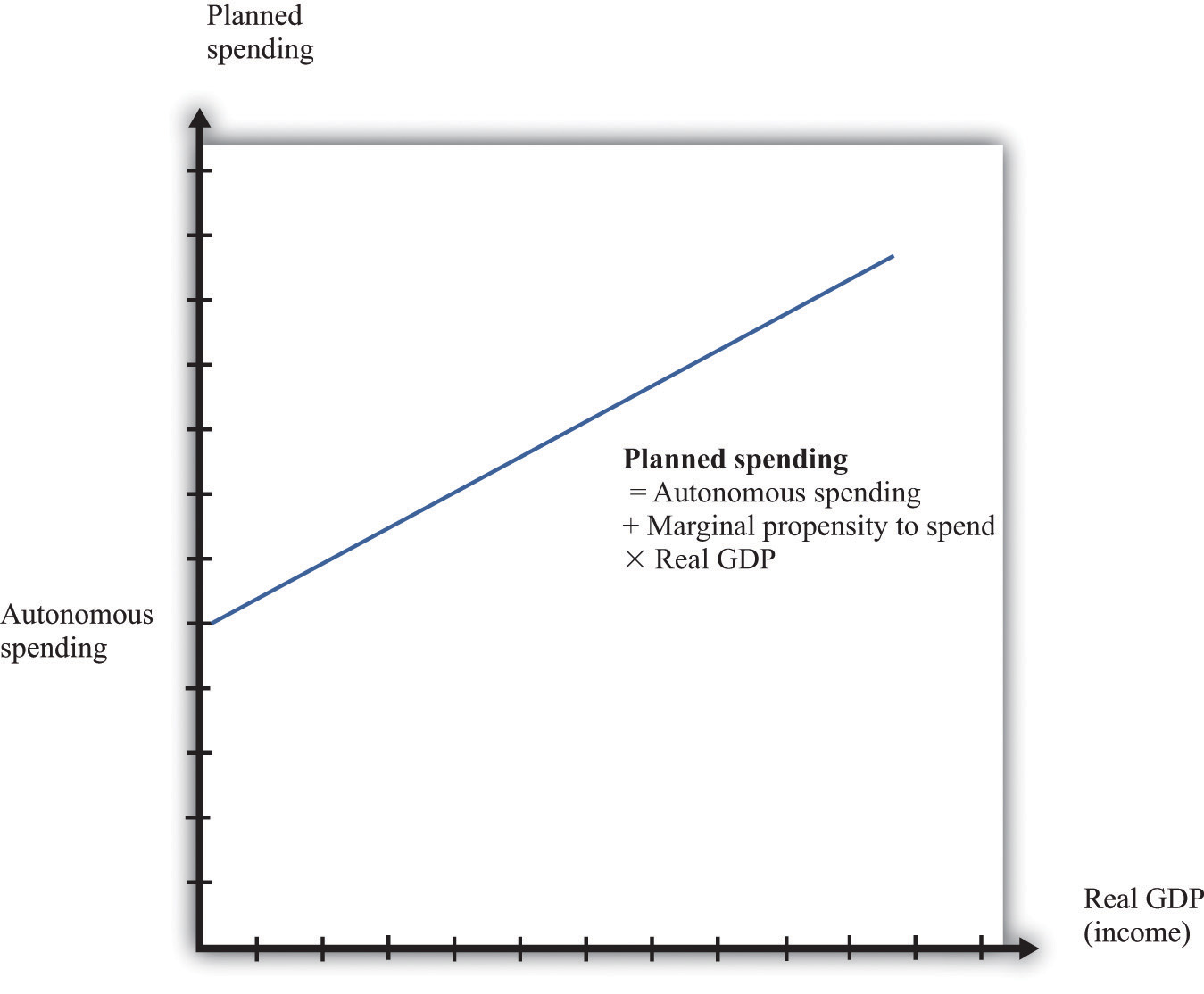

A higher marginal propensity to ... or taxes or imports and less to spending on domestic goods and services. Figure 9.7: The Construction of the Aggregate Expenditure Model · With the aggregate expenditure line in place, the next step is to relate it to the two other elements of the Keynesian cross diagram...

In an aggregate expenditures diagram, a lump-sum tax (t) will

1. Based on your understanding of the aggregate expenditure model, we know with certainty that an equal and simultaneous increase in G and T will cause: (a) an increase in output (b) no change in output (c) a reduction in output (d) an increase in investment (e) a decrease in investment

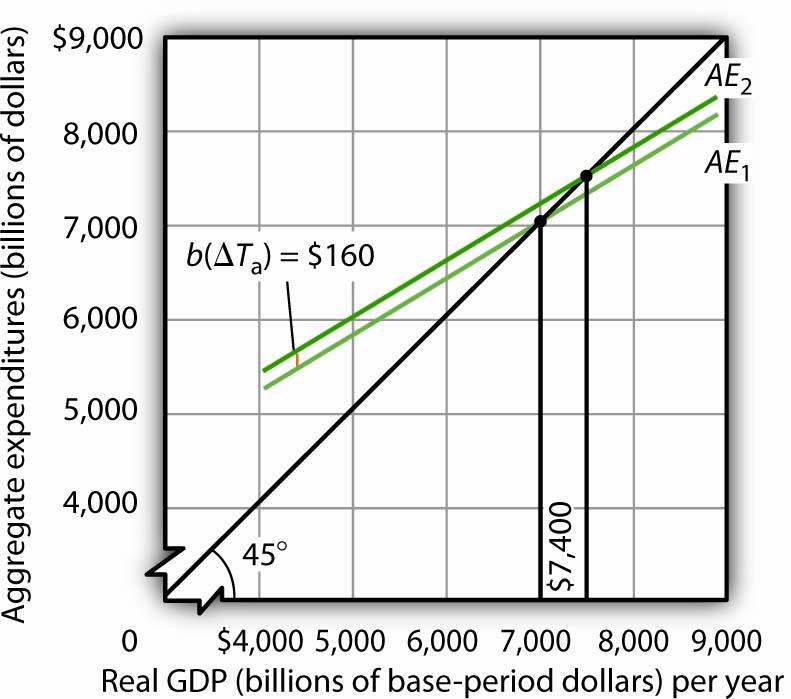

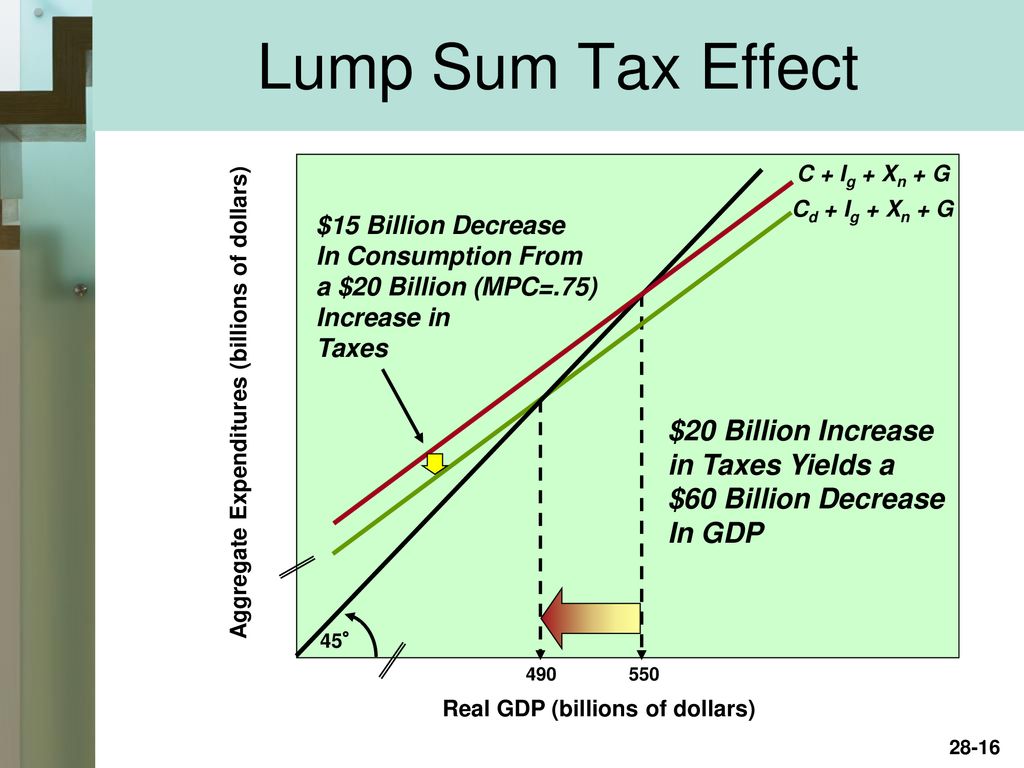

March 5, 2020 - In an aggregate expenditures diagram, a lump-sum tax (T) will. shift the C + Ig + Xn line downward by an amount equal to T × MPC. The effect of imposing a lump-sum tax is to. reduce the absolute levels of consumption and saving at each level of GDP but to not change the size of the multiplier

7.In a simple Keynesian model (with lump-sum taxes and a MPC of 0.8), a tax cut of $ 20 billion will have less of an impact on GDP than an increase in government spending of $ 10 billion. FALSE. The tax multiplier would be -4, so a tax cut of $ 20 billion would lead to GDP increasing by $ 80 ...

In an aggregate expenditures diagram, a lump-sum tax (t) will.

In an aggregate expenditures diagram, a lump-sum tax (T) will: asked Aug 10, 2018 in Economics by Tatil. A. not affect the C + I g + X n line. B. shift the C + I g + X n line upward by an amount equal to T. C. shift the C + I g + X n line downward by an amount equal to T.

In an aggregate expenditures diagram, a lump-sum tax (T ) will: a. not affect the C + Ig + Xn line. b. shift the C + Ig + Xn line upward by an amount equal to T. c. shift the C + Ig + Xn line downward by an amount equal to T. d. shift the C + Ig + Xn line downward by an amount equal to T × MPC.

At times when companies are struggling to pay the large lump sum of the quarterly tax bill, they turn to VAT loans. Should you have various other business expenses, a loan can provide relief. It can also allow your company to gain momentum again. A company might have a current project to complete that is generating increasing expenditures.

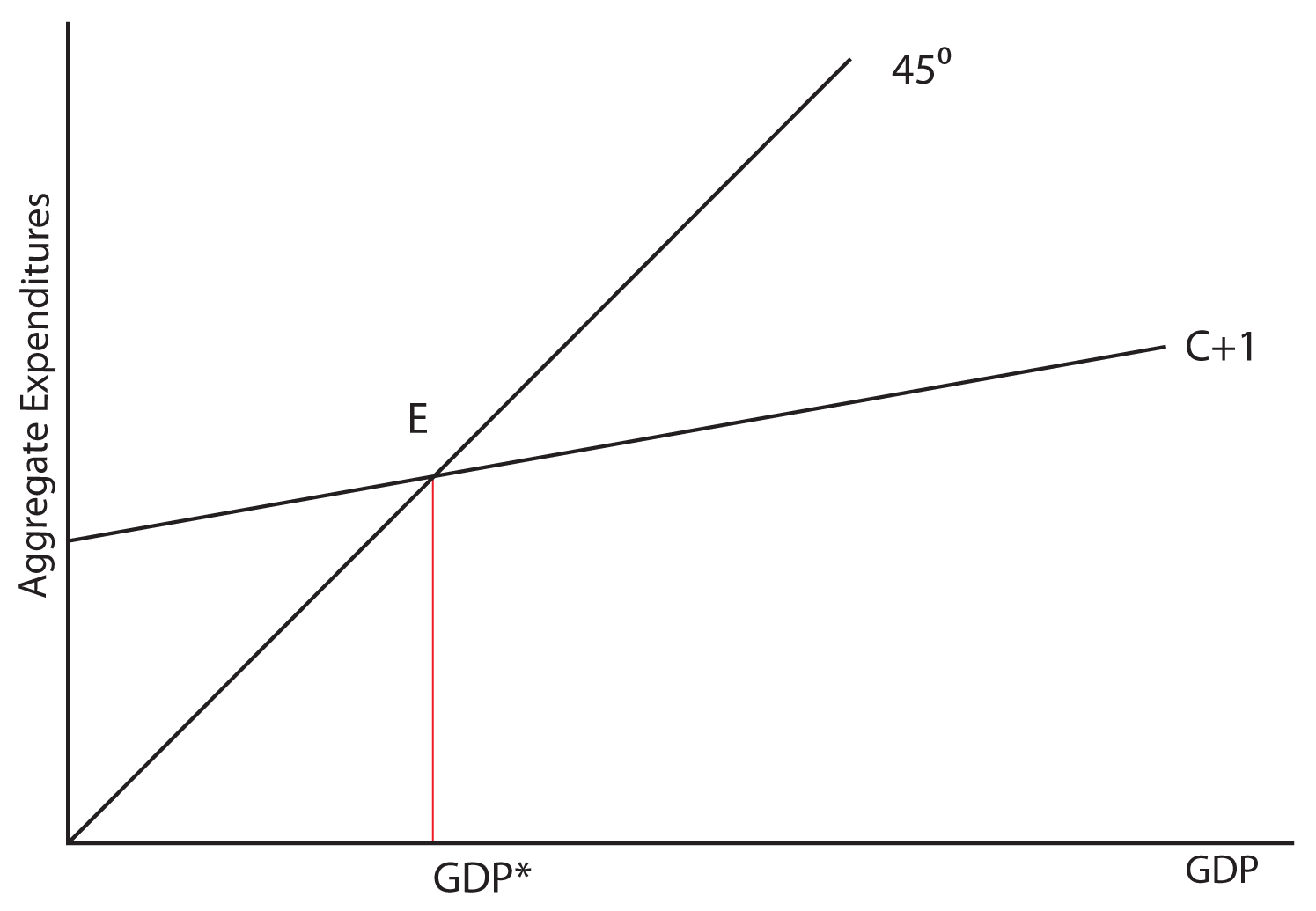

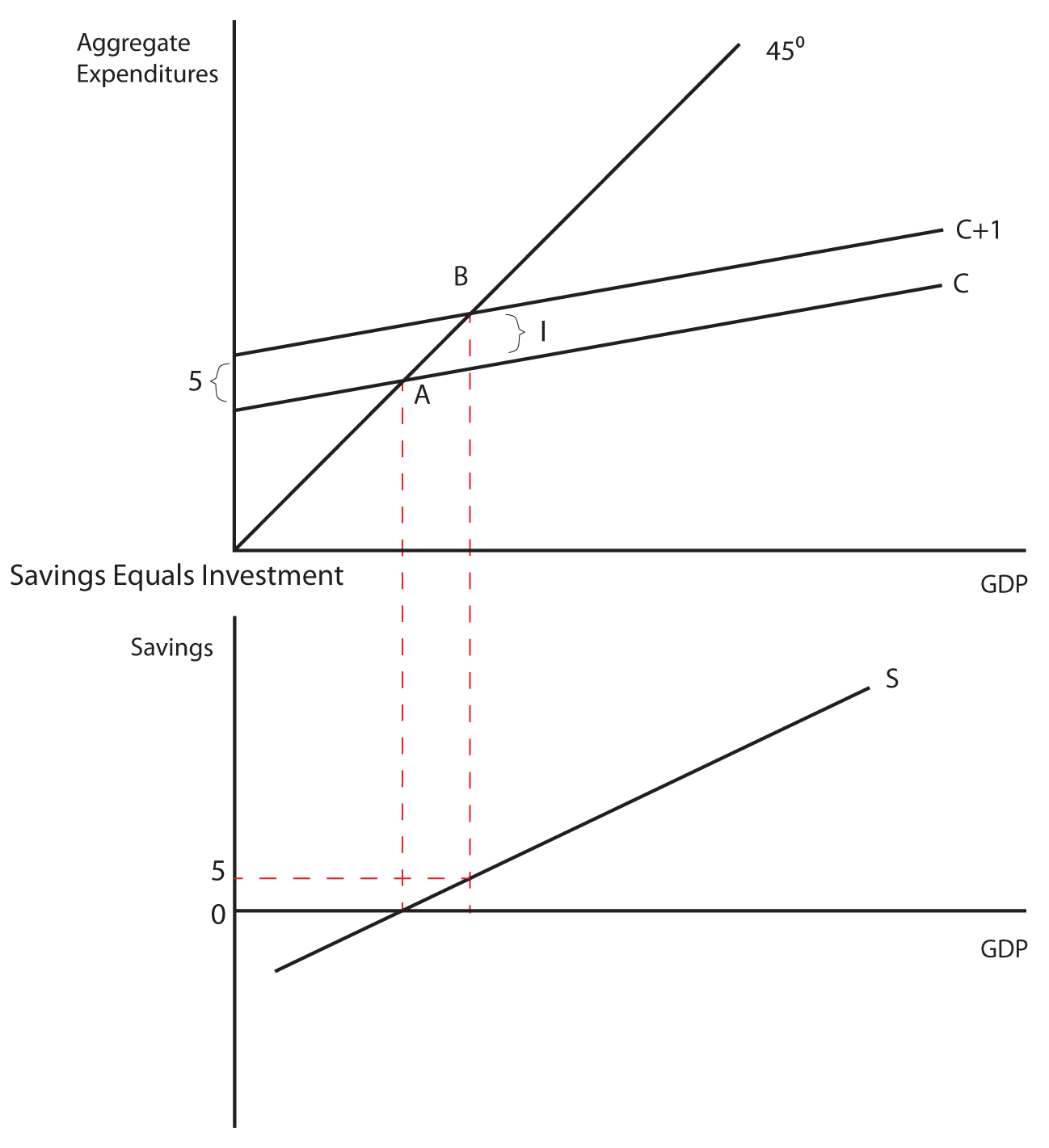

The Aggregate Expenditures Model Section 01: The Aggregate Expenditures Model. Now we will build on your understanding of Consumption and Investment to form what is called the Aggregate Expenditures Model. This model is used as a framework for determining equilibrium output, or GDP, in the economy.

2、2. In a simple circular-flow diagram, ( ) A、households spend all of their income. B、all goods and services are bought by households. C、expenditures flow through the markets for goods and services, while income flows through the markets for the factors of production. D、All of the above are correct.

29. If MPC = 0.75 (and there are no income taxes but only lump-sum taxes) when T decreases by 100, then the IS curve for any given interest rate shifts to the right by: A) 100. B) 200. C) 300. D) 400. 30. If the government wants to raise investment but keep output constant, it should: A) adopt a loose monetary policy but keep fiscal policy ...

In an aggregate expenditures diagram, a lump-sum tax (T) will: shift the C + Ig + Xn line downward by an amount equal to T × MPC. A lump-sum tax causes the after-tax consumption schedule:

(c) marginal tax rates on corporate and personal incomes. (d) reserves that banks are required to hold as percentages of their deposits. 3. Monetary policies likely to shift the Aggregate Demand curve from AD0 to AD1 would include an increase in: (a) government spending on schools, roads, and interstate highways.

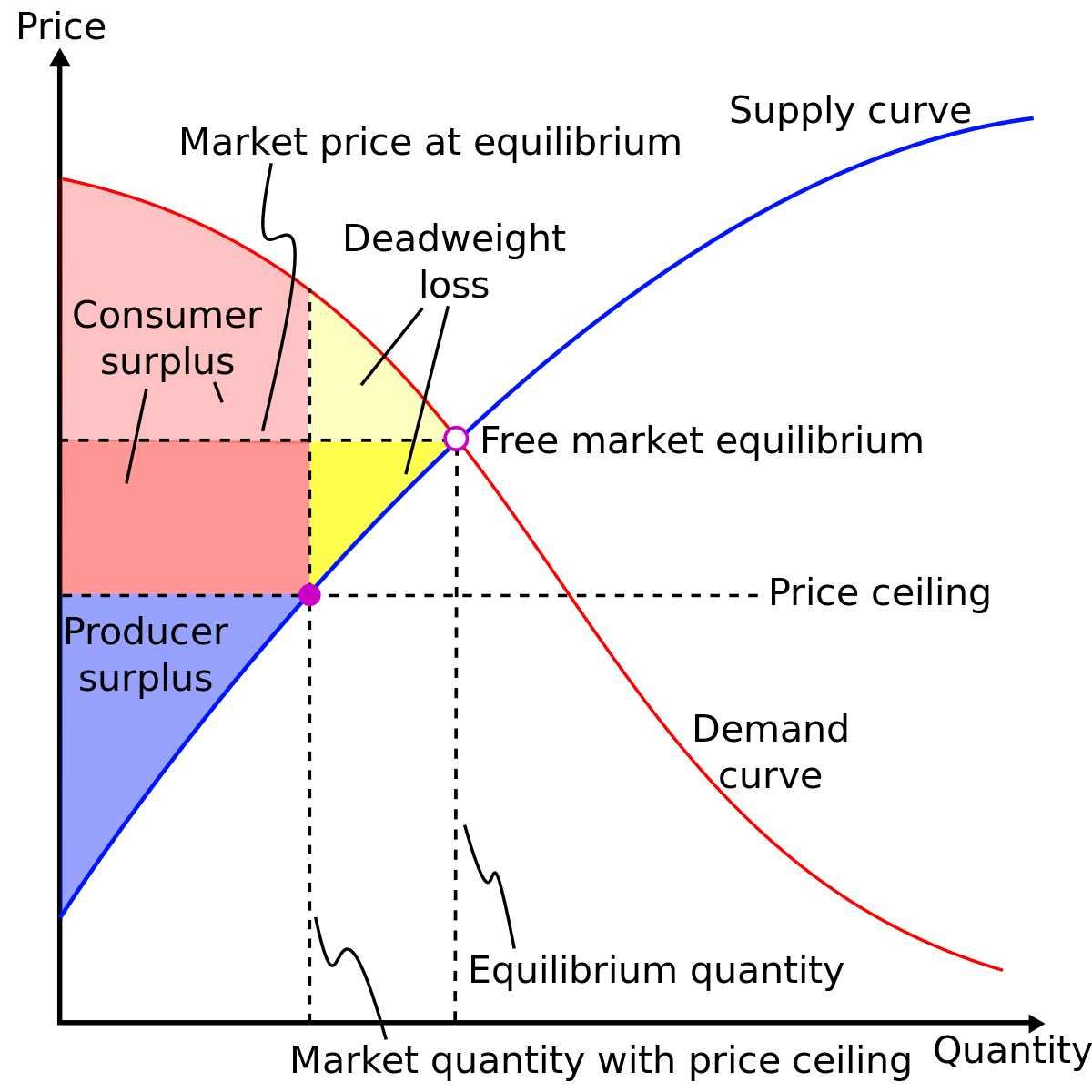

To put it another way, a tax on good causes the size of market for that good to decrease. Graph 4. In the graph, the deadweight loss can be seen as the shaded area between the supply and demand curves.

The Tax Equity and Fiscal Responsibility Act of 1982 (Pub.L. 97-248), also known as TEFRA, is a United States federal law that rescinded some of the effects of the Kemp-Roth Act passed the year before.Between summer 1981 and summer 1982, tax revenue fell by about 6% in real terms, caused by the dual effects of the economy dipping back into recession (the second dip of the "double dip ...

In an aggregate expenditures diagram the imposition of a lump-sum tax (T)will: A) not affect the C + IS1U1B1gS1U1B0 + XS1U1B1nS1U1B0 line. B) shift the C + IS1U1B1gS1U1B0 + XS1U1B1nS1U1B0 line upward by an amount equal to T. C) shift the C + IS1U1B1gS1U1B0 + XS1U1B1nS1U1B0 line downward by ...

The impact of the tax incentives decreased income taxes by $70 million, $53 million and $47 million in 2021, 2020 and 2019, respectively. The increase in tax benefit from 2020 to 2021 is primarily due to a change in the jurisdictional mix of non-U.S. earnings, which increased the earnings taxed at incentive tax rates in 2021. The calculation of ...

The company also said that it will continue to invest in e-commerce at an aggregate level. In the Personal Care business, it stands at around 70%, while it is in double digits in some of the businesses. The D2C progress pace got accelerated during the pandemic period due to rising digital activity.

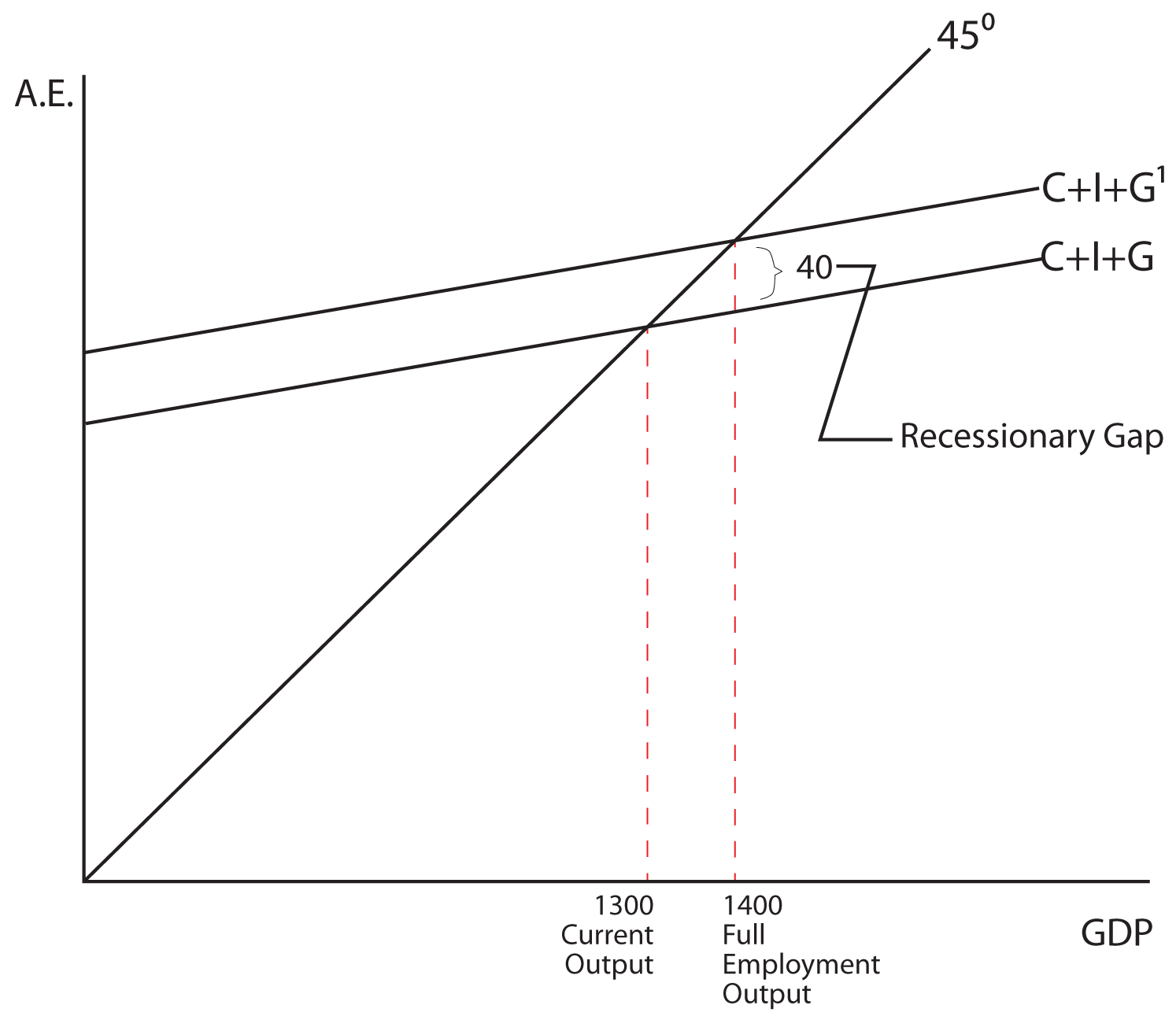

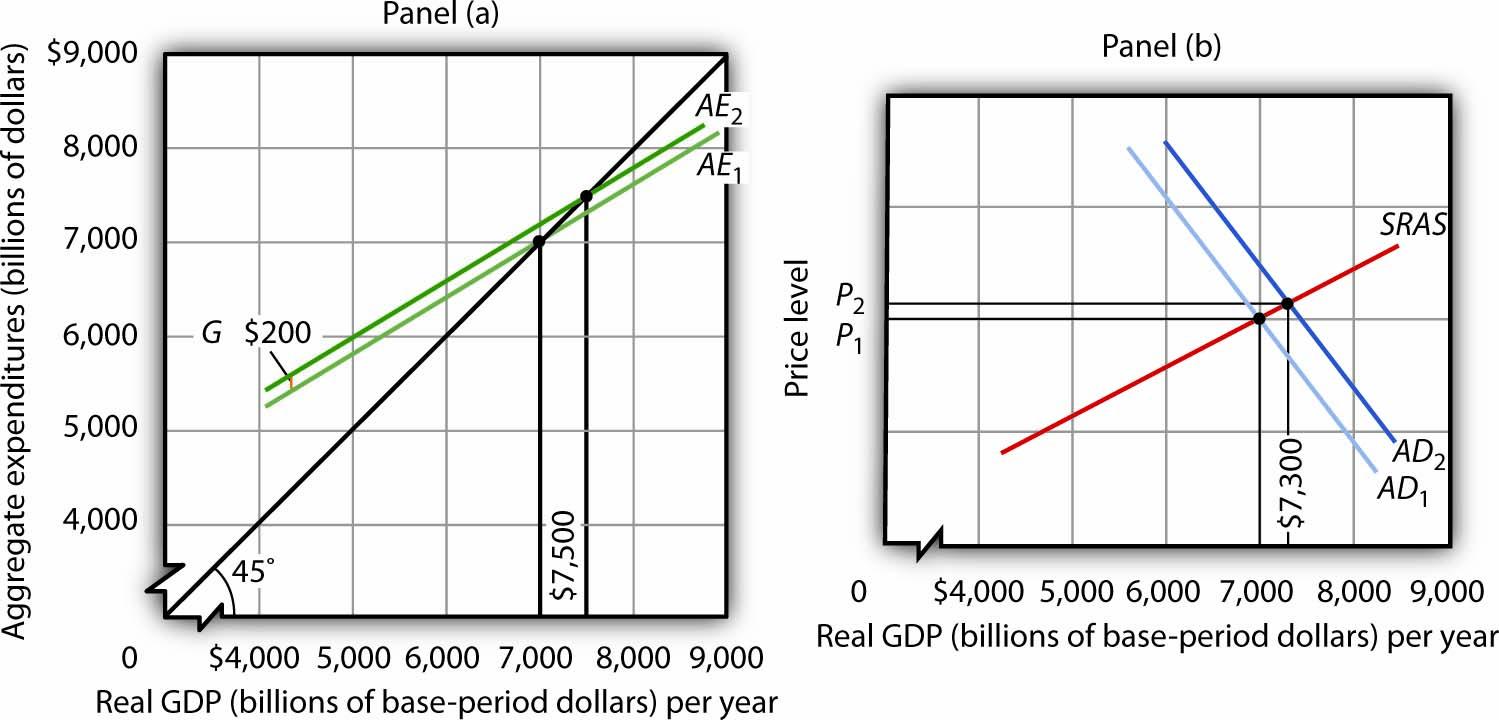

So an increase in government spending by $2 billion and a simultaneous increase in taxes by $2 billion will increase output by $2 billion. The balanced-budget multiplier is equal to 1 and can be summarized as follows: when the government increases spending and taxes by the same amount, output ...

Using vi/vim properly, you don't use it modally. You are always in normal mode, and only enter insert mode for short bursts of typing text, after which you press to go to normal mode. Thus, the remembering-the-mode problem just doesn't exist: you don't answer the phone in insert mode to get back to vi and not remember where you were.

In an aggregate expenditures diagram, a lump-sum tax (T) will A. not affect the C + Ig + Xn line. B. shift the C + Ig + Xn line upward by an amount equal to T. C. shift the C + Ig + Xn line downward by an amount equal to T. D. shift the C + Ig + Xn line downward by an amount equal to T × MPC.

(a) General definition. Gross income means all income from whatever source derived, unless excluded by law. Gross income includes income realized in any form, whether in money, pr

In an aggregate expenditures diagram a lump sum tax T will A not affect the C I from ECON 2020 at Utah Valley University

canegrati, emanuele (2007): The single-mindedness of labor unions when transfers are not Lump-Sum. D. Dalton, John (2012): The Evolution of Taxes and Hours Worked in Austria, 1970-2005. De Paola, Maria (2008): Absenteeism and Peer Interaction Effects: Evidence from an Italian Public Institute.

In an aggregate expenditures diagram, equal increases in government spending and in lump- sum taxes will: asked Aug 10, 2018 in Economics by LouTrumpet. A. shift the aggregate expenditures line downward. B. shift the aggregate expenditures line upward. C. leave the aggregate expenditures line ...

The university of bamenda. Higher institute of commerc and management. Competitive entrance examination. Academic year 2016/2017. Part one: economics (/400)

On a GAAP basis, a surplus is an excess of revenues over expenditures or expenses at the end of a fiscal year. ^ Top. T Tax and Revenue Anticipation Notes Tax and revenue anticipation notes (TRANs) refer to short-term obligations of the State. The notes must be redeemed within one-year of issuance.

The business generates free cash flow today or in the future. The value of the stock is the aggregate of the discounted future cash flow. So as a business thrives more than what we expect today, the share price should go up. An index is an aggregate of a bunch of businesses, so the value is derived as a result of that.

The diagram above shows that as aggregate demand increases from AD1 to AD2 the general price level increases from P1 to P2 and an increase in national output from Y1 to Y2 occurs. A further increase in aggregate demand from AD2 to AD3 will start an inflationary process because at this level full employment level has reached and output can no ...

The Tax Act, among other things, includes changes to U.S. federal corporate income tax rate, imposes significant additional limitations on the deductibility of interest, allows for the accelerated expensing of capital expenditures, and puts into effect the migration from a "worldwide" system of taxation to a territorial system.

What is the lump-sum tax multiplier? -3; the lump-sum tax multiplier is always one less than the simple multiplier and negative_ or = -MPC/MPS = _.75/.25 = -3 11. What change in taxes is needed to achieve full employment? _____ Change in GDP = change in taxes x lump-sum tax multiplier $100 ...

Learn About Insurance Companies. Major December 14, 2021. The Surest Existence Coverage Groups. Insurance policies that pay out in cash can also be a good way to supplement income or fund a project after you circulate. Some individuals want the alternative to abjure or borrow against the cash price, or consume it to pay their premiums.

In an aggregate expenditures diagram, equal increases in government spending and in lump-sum taxes will A)shift the aggregate expenditures line downward. B)shift the aggregate expenditures line upward. C)leave the aggregate expenditures line unchanged. D)reduce the equilibrium GDP.

Jan 21, 2015 · Econ 102 Discussion Section 7 (Chapter 12) March 13. 2015 ! We can illustrate these ideas graphically. If we place the function AE = Y on the graph containing the aggregate expenditures function, it represents all of the possible equilibrium points in the

Equal increases in government purchases and taxes will. increase the equilibrium GDP and ... In an aggregate expenditures diagram, a lump-sum tax (T) will. Rating: 5 · 2 reviews

Which aggregate expenditure schedule(s) AE in the diagram for a private closed ... If an additional lump-sum tax of $20 were imposed, we would expect:. Rating: 5 · 1 review

Expert solutions for 161.Answer the question on the basis of the following table:The tax in:1637644 ...

In an aggregate expenditures diagram, equal increases in government spending and in lump-sum taxes will: shift the aggregate expenditures line upward.

Economics MCQ: Get the easy explanations of MCQ on Economics. It covers all the MCQ questions for class 11th and 12th Economics Subject. Stay Tuned to BYJU'S to learn more.

Bloomberg Surveillance. December 15th, 2021, 6:34 PM PST. Tom Keene, Jonathan Ferro and Lisa Abramowicz host Bloomberg's special coverage of the announcement of the Fed rate decision and Chairman ...

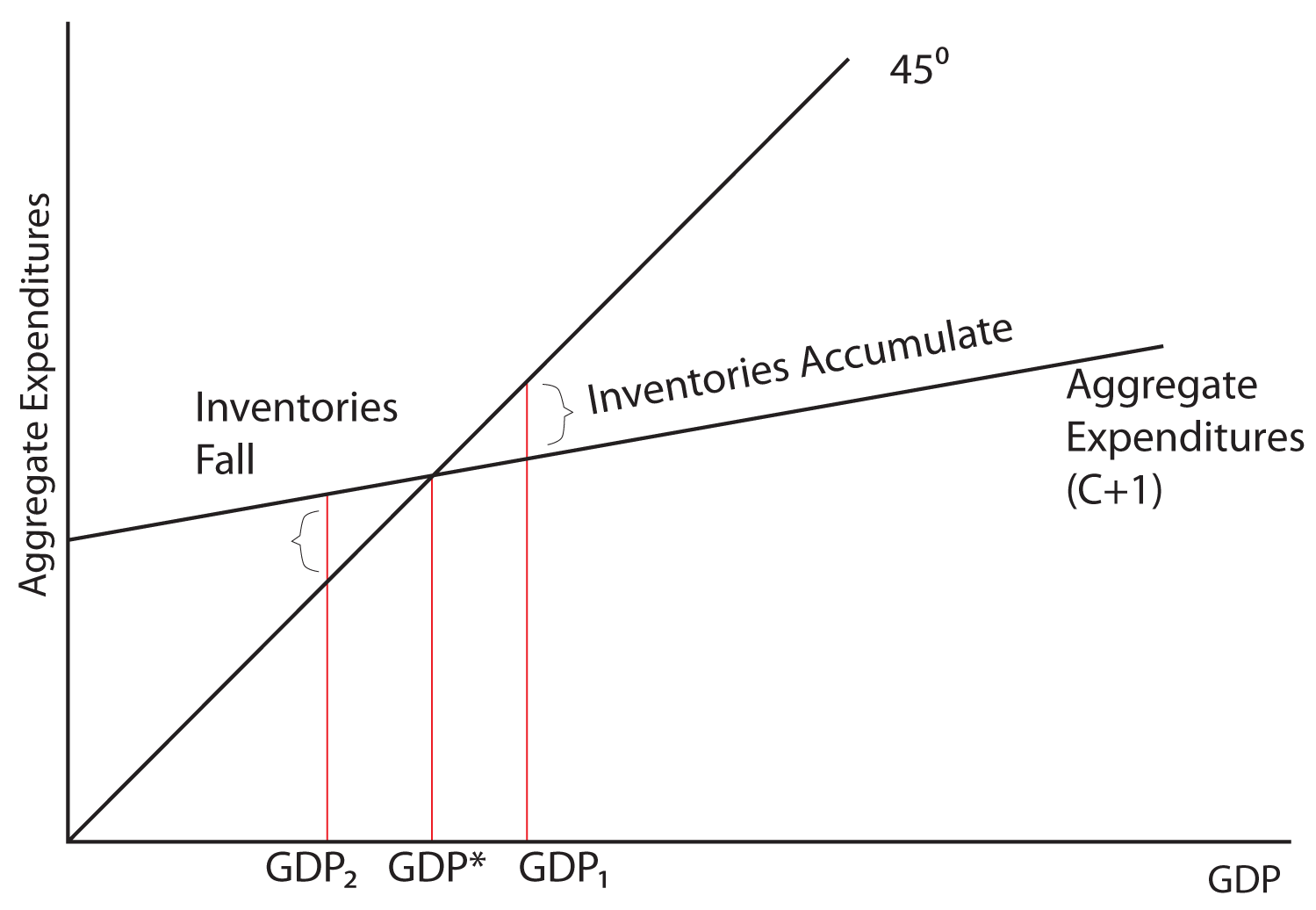

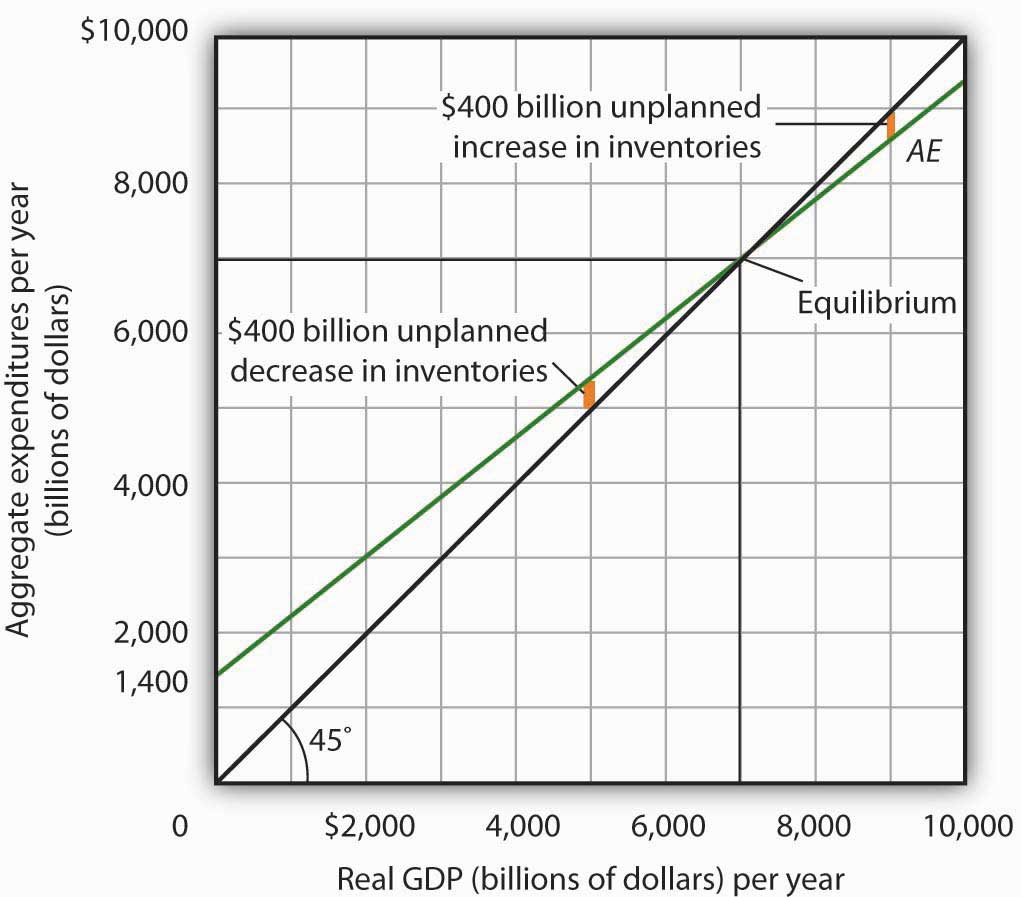

If aggregate expenditures fall short of real GDP in the Keynesian model, then: a. employment falls as the economy attains equilibrium. b. the economy will have deflation. c. firms are depleting the...

In an aggregate expenditures diagram, a lump-sum tax (T) will: A) shift the C +1 + Xn line downward by an amount equal to T x MPC. B) shift the C +1 + Xn line upward by an amount equal to T.

In an aggregate expenditures diagram, a lump-sum tax (T) will: shift the C + I g + X n line downward by an amount equal to T × MPC. 17. An increase in taxes will have a greater effect on the equilibrium GDP: the larger the MPC. 18. In a private closed economy, when aggregate expenditures equal ...

C) Where aggregate demand and aggregate supply intersect is always the full-employment level of output. D) In the short run, the level of output is determined by demand. 16) In the United States during the 1930s16) _____ A) government spending increased and taxes decreased, resulting in a fiscal expansion.

Transitional Dynamics and Long-Run Optimal Taxation under

As the amount of the lump-sum settlement exceeded the sum of the service and interest cost for the year, the distribution was treated as a settlement in accordance with U.S. GAAP, resulting in ...

If the MPC is 0.75, the lump-sum tax multiplier will be -4, that is, an increase in taxes of $ 100 billion will lead to a drop in GDP of $ 400 billion. The tax multiplier will be -3. Consider the simple Keynesian model with GDP = C + I + G and C = .75 (GDP - T) Since GDP = .75 GDP - 0.75 T + I + G, we have:

c. Corporate tax payments increase in an expansion. d. More people enroll in welfare during recessions. e. The average personal income tax rate rises in expansions. 45. Christina is an economist who believes that shifts in aggregate demand cause both a change in real output and the price level.

In an aggregate expenditures diagram, equal increases in government spending and in lump-sum taxes will: shift the aggregate expenditures line upward.

shift the C + Ig + Xn line downward by an amount equal to T × MPC. In an aggregate expenditures diagram, a lump-sum tax (T) will:. Rating: 5 · 1 review

0 Response to "34 in an aggregate expenditures diagram, a lump-sum tax (t) will"

Post a Comment