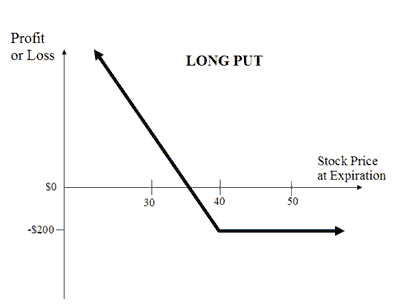

39 short put payoff diagram

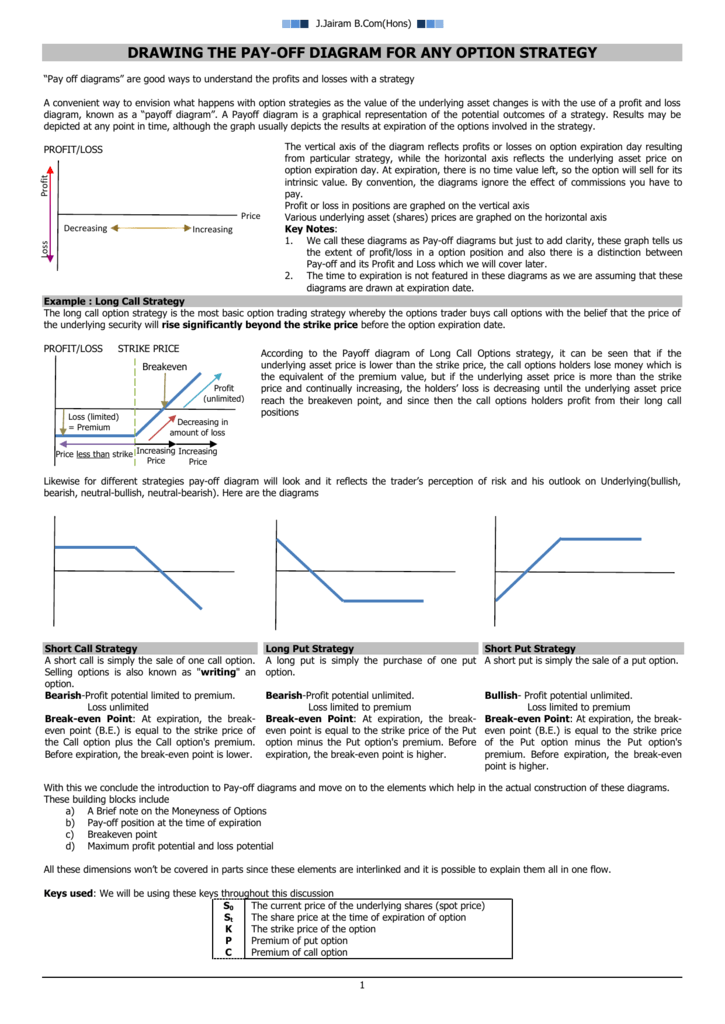

Short put: sellers of put options hope the stock price to go up or stay around current levels. If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited. For a long position this payoff is: = For a short position, it is: f T = K − S T {\displaystyle f_{T}=K-S_{T}} Since the final value (at maturity) of a forward position depends on the spot price which will then be prevailing, this contract can be viewed, from a purely financial point of view, as "a bet on the future spot price" [3]

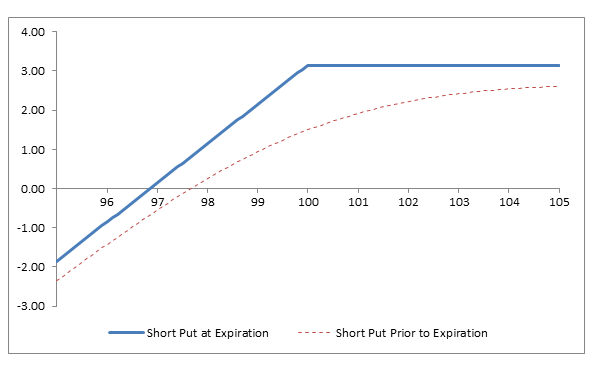

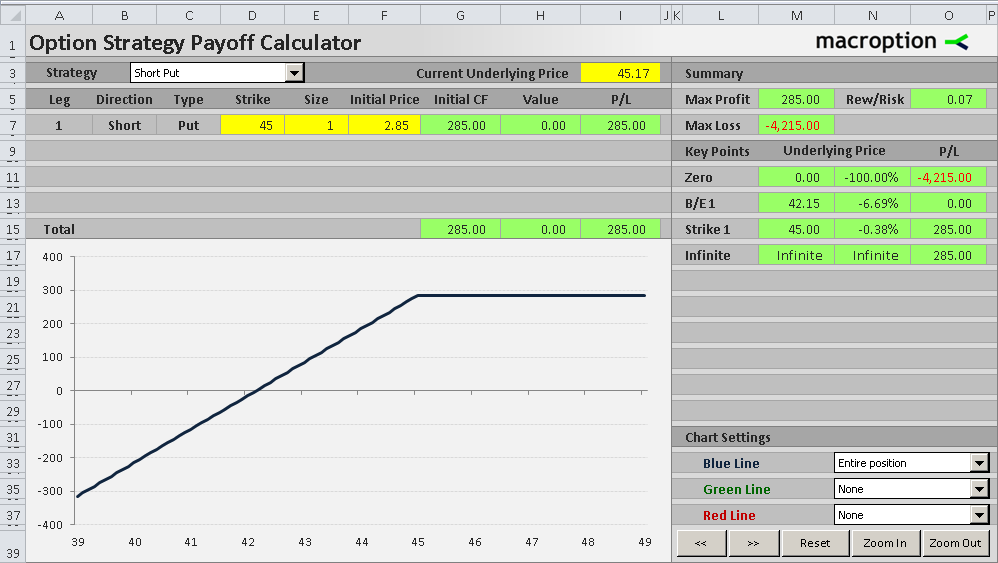

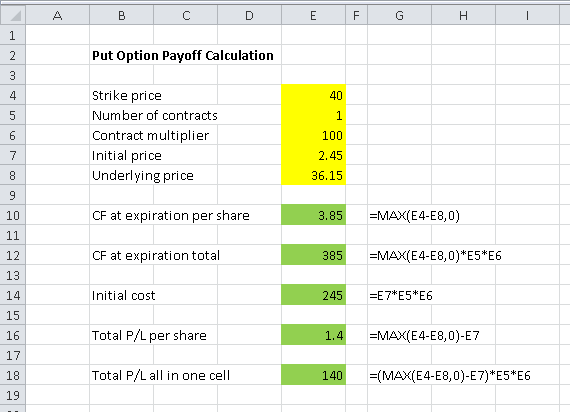

Besides the strike price, another important point on the payoff diagram is the break-even point, which is the underlying price where the position turns from losing to profitable (or vice-versa). On the chart it is the point where the profit/loss line crosses the zero line and you can see it’s somewhere between 37 and 38 in our example.

Short put payoff diagram

Pedagogical study of options education tools using traditional methods versus the RoToR Payoff Diagram®. Please click on the title to find the latest project... Long Call Short Underlying Bull Call Spread Bear Put Spread Long Straddle Collar What We Do We provide innovative education and training in Stocks, Shares, Forex, Indices What we are looking at here is the payoff graph for a short put option strategy. In this example the trader has sold a 330 strike put for $6 per contract (or $600 for a standard option contract representing 100 shares). The premium collected of $600 is the most the trade can profit. That occurs at an underlying stock price of $330 and above. As 'Money Logging' Flies Off The Shelf At Amazon 9 December 2014 Back on sale, despite the threats and... to pay CMS RM400million to acquire plantation rights on native customary lands in order to access them. Taib... The result is devastating: 90 percent of that forest put to the chainsaw, to sell timber worth US$50 billion.... Secure Key Contact instructions Donate to Sarawak Report Facebook Twitter Subscribe to our mailing list Your...

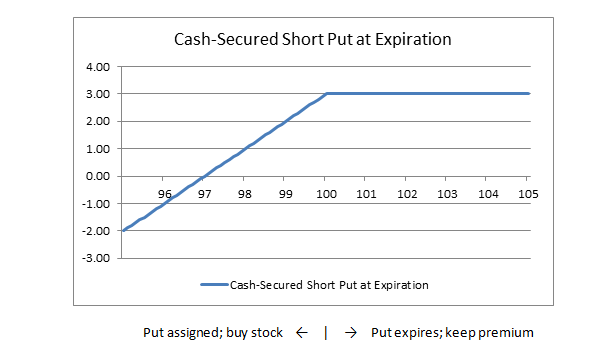

Short put payoff diagram. Nov 25, 2014 · The short answer is yes but the real answer is both companies are heading more and more toward the Nash equilibrium we predicted. For example, prior to Google’s purchase of Motorola in 2011, Motorola would often cave to carrier demands by offering phones that were exclusive to specific carriers and full of carrier-specific applications. Nov 05, 2020 · Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position’s total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example: What we are looking at here is the payoff graph for a short call option strategy. Occasionally in derivatives design you need to put a pot of cash somewhere, and it was a dumb slow revelation to me how hard it is to … just … ... a pot of... Bitcoin short-seller, and your Bitcoins can bop off around the blockchain doing productive work in weird places while you sleep, and the whole regular financial... Bull put spreads can be implemented by selling a higher striking in-the-money put option and buying a lower striking out-of-the-money put option on the same underlying stock with the same expiration date.. Limited Upside Profit. If the stock price closes above the higher strike price on expiration date, both options expire worthless and the bull put spread option strategy earns …

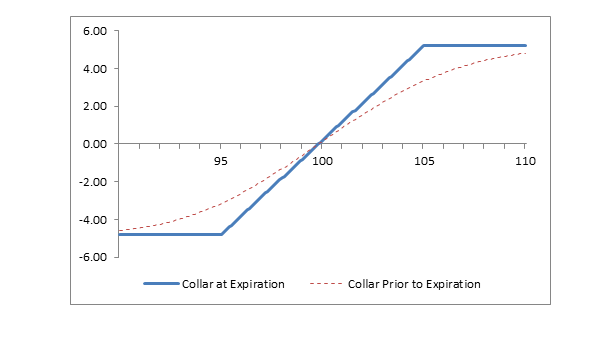

Goals should be specific, even if they are only short-term goals (for example, taking 30 customer service calls per day or sending 100 email newsletters to clients every month). Setting vague goals does not bode well for any employee as well as any company as it will not properly guide the company and the employee on what they need to do. Let's visualize this table by looking at an expiration payoff diagram and trade performance visualization of a real short put spread in NFLX. Bull Put Spread Example. In the following example, we'll examine a short put spread in NFLX that experiences both profits and losses over the duration of the trade. Here are the specific trade details: Short put option positions, therefore, have positive deltas. At-the-money short puts typically have deltas of approximately +50%, so a $1 rise or fall in stock price causes an at-the-money short put to make or lose approximately 50 cents. In-the-money short puts tend to have deltas between +50% and +100%. (A) A zero-width, zero-cost collar can be created by setting both the put and call strike prices at the forward price. (B) There are an infinite number of zero-cost collars. (C) The put option can be at-the-money. (D) The call option can be at-the-money. (E) The strike price on the put option must be above the forward price. 2.

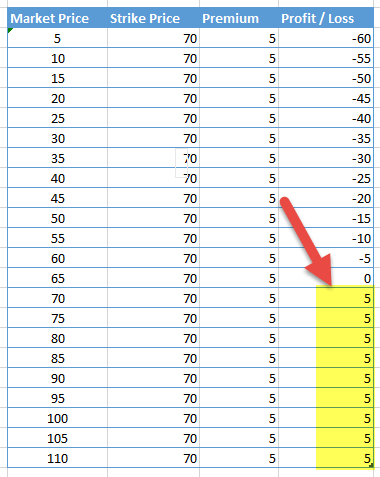

Feb 06, 2017 · However, payoff charts become very useful when looking at combinations of options i.e. when more than one leg is in the strategy. Take an option straddle for example. A straddle is a combination of two options; a long call and long put option with the same expiration dates and strike prices. Below is a straddle graph. The payoff diagram for a short put represents the risk involved with selling naked options. Profit potential is limited to the amount of credit received when the put is sold. The risk is undefined until the stock reaches $0. For example, if a short put option with a strike price of $100 is sold for $5.00, the maximum profit potential is $500. I have this simple Feynman diagram with a circle: I would like to put the number "1" in the middle of that circle. I've tried these: \fmfiv{lab=1}{c} \fmfiv{lab=1}{.5[nw,se]) \fmfiv{lab=1}{(.4999w, .5h)} \fmfiv{lab=1}{(.5001w, .5h)} but whatever constants I put, latex refuses to put it INSIDE the circle. The latex... I put a label inside a Feynman... of diagram cropped off? 1 Feynman... to pay rent? Do the Quick Jump and Powerful... A short put spread obligates you to buy the stock at strike price B if the option is assigned but gives you the right to sell stock at strike price A. A short put spread is an alternative to the short put. In addition to selling a put with strike B, you’re buying the cheaper put with strike A to limit your risk if the stock goes down.

“Having parallel development would obviously decrease the waiting time, but it increases the short-run need for funding,” Lo says. “Given how much of an... “With a sufficiently high likelihood of success, you can issue debt to attract a large group of bondholders who would be willing to put their money to work,” Lo...

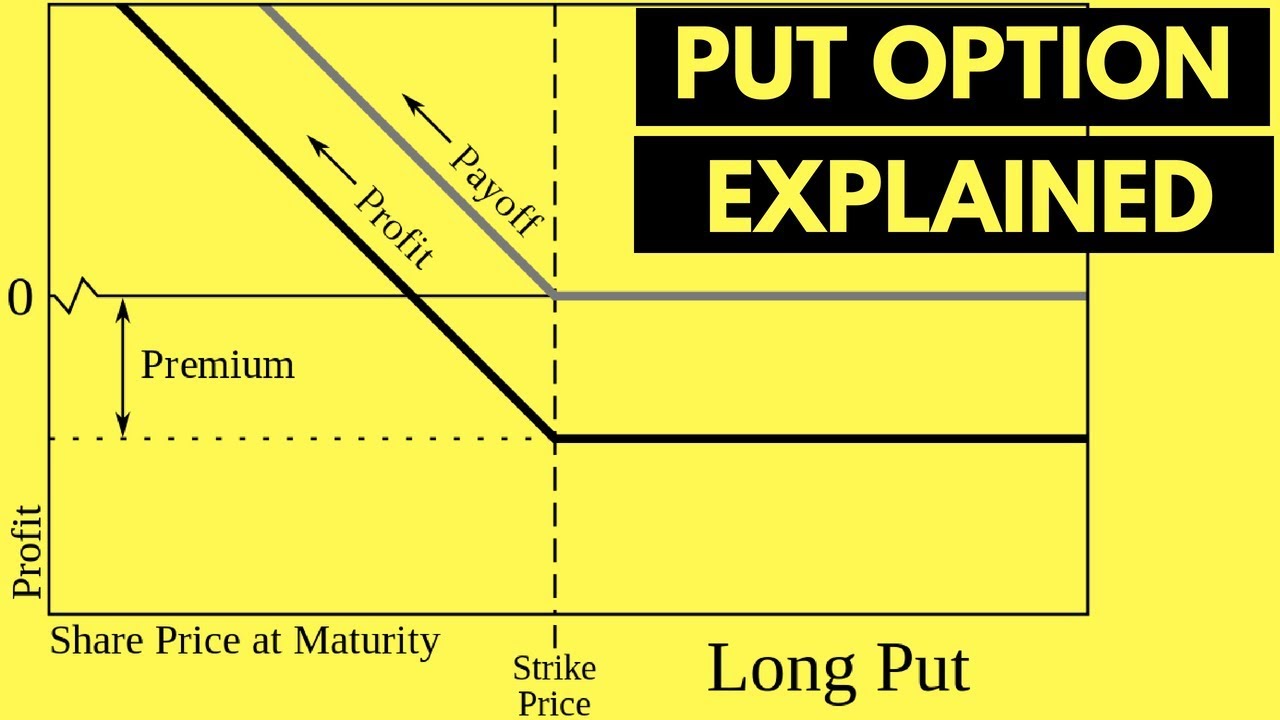

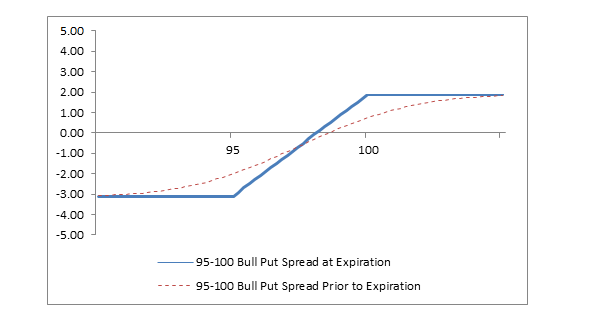

Because put options, when exercised, provide a short position in the underlying asset, they are used for hedging purposes or to speculate on downside price action.... The possible payoff for a holder of a put is illustrated in the following diagram: Image by Julie Bang © Investopedia 2019 Puts vs. Calls Derivatives are... or Short a Derivative? Options Trading Strategy & Education How to Sell Put Options to Benefit in Any Market...

Some of the links within certain pages are affiliate links of which TradeOptionsWithMe receives a small compensation from sales of certain items.

Latest News for: payoff Edit Gunmen abduct 30 students in northwest Nigeria as payoffs 'boomerang' Reuters12 Mar 2021 . Edit Rep. McCarthy calls the $1.9 trillion COVID bill a 'payoff to Pelosi's political friends' Fox News12 Mar 2021 Rep.Kevin McCarthy discusses PresidentBiden’s primetime speech and the issues on the... readings off the scale The Guardian | 15 Mar 2021 Russians burn 24m 'corona castle' to celebrate Maslenitsa and...

Lloyd Blankfein is sworn in to testify before the Senate Subcommittee on Investigations hearing on Wall Street investment banks and the financial crisis on Capitol Hill, April 27, 2010. (AP/Susan Walsh) In the financial crisis of 2007-08, Computer Business Systems (CBS) performed on a much bigger stage than any we have... News & Politics Culture Food Science & Health Life Stories Video Goldman Sachs' sick con: How they made money off...

One Year Later, Facebook Killing Off Places …To Put Location Everywhere MG Siegler @mgsiegler / 5:27 AM... Below, find the flow diagram of how it will now work. Sign up for Newsletters See all newsletters(opens in a... to pay for. 3 factors to consider when adding remote visual assistance software to your tech stack Gary York... About TechCrunch Staff Contact Us Advertise Legal Privacy Policy Terms of Service TechCrunch+ Terms Code of...

Nowadays, I don’t just avoid trying to guess the short-term movements of individual stocks. I avoid looking at financial markets and news entirely, for weeks or months at a time. This is a much better way to invest. In fact, doing just this will not only put you ahead of most average Joes, but you will also beat the vast...

Short Put Payoff Diagram A short put option position is a bullish strategy with limited upside and limited (but usually very high) risk. The position is initiated by selling a put option with the intention to buy it back later at a lower price or waiting until expiration and hoping it will expire out of the money. See the payoff chart below:

A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan. Google Classroom Facebook Twitter Email Sort by: Tips & Thanks Video transcript

Learn more Nice scientific pictures show off Ask Question Asked7 years, 11 months ago Active28 days ago... Of course, it must be done with LaTeX & Friends : the post must start with a short sentence to present the... It would not make the diagram any clearer to me, but it might well to some people. The critical factor here is...

The Chinese company, which is backed by the China Government, will help pay off the 1MDB dept in advance and progressively. In return, this Chinese company will be rewarded with high profits and land, and of course extra influence with the Malaysian government”. The outrageous plan is blatantly laid out in the term sheet and...

Dec 03, 2015 · Graph 4 (bottom left) – If you expect a moderate move during the 2 nd half of the series, and you expect the move to happen on expiry day, then the best strikes to opt are ATM i.e 8000 (lower strike, long) and 8300 (higher strike, short). Do note, far OTM options lose money even if the market moves up.

The short put ladder, or bull put ladder, is a unlimited profit, limited risk strategy in options trading... For instance, a sell off can occur even though the earnings report is good if investors had expected great... Some stocks pay generous dividends every quarter. You qualify for the dividend if you are holding on the...

The crucial point in the transaction is the use of the switch by the instigator to catch out the mark, who then feels inferior or stupid and therefore ends the conversation leading to a payoff for the instigator. Such ‘games’ lead to negative relationships, as there is an underlying power struggle and negative reinforcement in terms of self ...

full pay for its employees by mid-September, CEO Jeremy Zimmer said in a memo to staff on Wednesday.... laid off roughly 50 employees across several divisions on Wednesday, some of whom had previously been... just short term but for the foreseeable future,” Zimmer wrote. “The most important thing we can do right now is...

Apr 14, 2020 · the butterfly payoff diagram As you can see above the butterfly payoff diagram, or expiration graph, has a tent-like shape with the potential for very large profits around the short strike. It’s important to keep in mind that it’s unlikely you would ever achieve the maximum profit.

As 'Money Logging' Flies Off The Shelf At Amazon 9 December 2014 Back on sale, despite the threats and... to pay CMS RM400million to acquire plantation rights on native customary lands in order to access them. Taib... The result is devastating: 90 percent of that forest put to the chainsaw, to sell timber worth US$50 billion.... Secure Key Contact instructions Donate to Sarawak Report Facebook Twitter Subscribe to our mailing list Your...

What we are looking at here is the payoff graph for a short put option strategy. In this example the trader has sold a 330 strike put for $6 per contract (or $600 for a standard option contract representing 100 shares). The premium collected of $600 is the most the trade can profit. That occurs at an underlying stock price of $330 and above.

Pedagogical study of options education tools using traditional methods versus the RoToR Payoff Diagram®. Please click on the title to find the latest project... Long Call Short Underlying Bull Call Spread Bear Put Spread Long Straddle Collar What We Do We provide innovative education and training in Stocks, Shares, Forex, Indices

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

.png)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

0 Response to "39 short put payoff diagram"

Post a Comment